Time Flies, Features Stay: The Ultimate Guide to Multifunction Watches for Millennials

Millennials, the generation sandwiched between Gen X and Gen Z, are known for their fast-paced lives, juggling careers, relationships, and personal passions. In this whirlwind, every second counts, and...

For You, With Love: Styling and Gifting the Glamorous Rose Gold Chain

Rose gold - the very name conjures up images of elegance, warmth, and timeless beauty. It's a colour that transcends trends, holding a special place in the hearts of...

How to Choose the Right Same Day Delivery Courier for Your Business?

Delivering same day delivery is seen by customers in the fast-moving world as a transformative act to make your business a leader. It enables you to meet your client's...

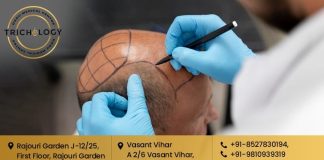

दिल्ली एनसीआर में हेयर ट्रांसप्लांट सर्जरी के लिए सर्वोत्तम क्लिनिक कैसे खोजें?

एक उपयुक्त हेयर ट्रांसप्लांट क्लिनिक वो होगा जो बालों के झड़ने की समस्याओं और गंजेपन के इलाज के लिए चिकित्सकीय रूप से स्वीकृत उपचार उपलब्ध करवाता है। उच्च-गुणवत्ता की...

Top 4 Branded Watches for Your Wardrobe

Imagine a world where time isn't just a number on a screen, but a tangible sensation felt on your wrist. A world where the gentle tick of a watch...

Trending Now

All

- All

- Appliances

- AutoMobile

- Blogging

- Champs Corner

- Crypto

- Education

- Entertainment

- Facts & Tricks

- Fashion

- Featured

- Finance

- Funny

- Gadgets

- Gaming

- Health

- Hindi Stories

- Hindi Stories

- Historical

- How To

- Kya or Kaise

- Legends

- Lifestyle

- Marketing

- Motivational

- Pet

- Relations

- Social Selfie

- Software

- Tech Updates

- Technology

- Tips & Tricks

- Top 10

- Travel Diary

Haridwar One Day Travel Itinerary

Haridwar, one of India's seven holiest locations, is a destination of great cultural and religious significance that captivates people with its ethereal and spiritual...

Time Flies, Features Stay: The Ultimate Guide to Multifunction Watches for...

Millennials, the generation sandwiched between Gen X and Gen Z, are known for their fast-paced lives, juggling careers, relationships, and personal passions. In this...

For You, With Love: Styling and Gifting the Glamorous Rose Gold...

Rose gold - the very name conjures up images of elegance, warmth, and timeless beauty. It's a colour that transcends trends, holding a special...

How to Choose the Right Same Day Delivery Courier for Your...

Delivering same day delivery is seen by customers in the fast-moving world as a transformative act to make your business a leader. It enables...

दिल्ली एनसीआर में हेयर ट्रांसप्लांट सर्जरी के लिए सर्वोत्तम क्लिनिक कैसे...

एक उपयुक्त हेयर ट्रांसप्लांट क्लिनिक वो होगा जो बालों के झड़ने की समस्याओं और गंजेपन के इलाज के लिए चिकित्सकीय रूप से स्वीकृत उपचार...

Top 4 Branded Watches for Your Wardrobe

Imagine a world where time isn't just a number on a screen, but a tangible sensation felt on your wrist. A world where the...

LATEST ARTICLES

Haridwar One Day Travel Itinerary

Haridwar, one of India's seven holiest locations, is a destination of great cultural and religious significance that captivates people with its ethereal and spiritual atmosphere. Your one-day Delhi to...

Time Flies, Features Stay: The Ultimate Guide to Multifunction Watches for Millennials

Millennials, the generation sandwiched between Gen X and Gen Z, are known for their fast-paced lives, juggling careers, relationships, and personal passions. In this whirlwind, every second counts, and...

For You, With Love: Styling and Gifting the Glamorous Rose Gold Chain

Rose gold - the very name conjures up images of elegance, warmth, and timeless beauty. It's a colour that transcends trends, holding a special place in the hearts of...

How to Choose the Right Same Day Delivery Courier for Your Business?

Delivering same day delivery is seen by customers in the fast-moving world as a transformative act to make your business a leader. It enables you to meet your client's...

दिल्ली एनसीआर में हेयर ट्रांसप्लांट सर्जरी के लिए सर्वोत्तम क्लिनिक कैसे खोजें?

एक उपयुक्त हेयर ट्रांसप्लांट क्लिनिक वो होगा जो बालों के झड़ने की समस्याओं और गंजेपन के इलाज के लिए चिकित्सकीय रूप से स्वीकृत उपचार उपलब्ध करवाता है। उच्च-गुणवत्ता की...

Top 4 Branded Watches for Your Wardrobe

Imagine a world where time isn't just a number on a screen, but a tangible sensation felt on your wrist. A world where the gentle tick of a watch...